Premium Billing - Creating and Managing Invoices

Premium Billing consists of the following primary functions:

Generating Invoices to collect Policy Premium

Collecting payments and reconciling automatically

Providing Payment Plans (Monthly or Quarterly) and supporting down payments

Prerequisite

Behind the scenes, AI Insurance uses Stripe to process payments. The first step in the process is setting up Cash Management within our Application. Please click here to learn more.

Creating an Invoice

Once Premium Billing is enabled, there will be a new section added to the Policy Creation modal called “Set Billing” that displays the invoice’s line items.

Adding a line item

Similar to Custom Adjustments for premium bearing entities, you can add additional fees when creating invoices. New additions will appear directly on the generated invoice.

Billing Information Email

After creating the invoice, we’ll automatically send the invoice to the email address provided. This can be the email of the insured, their broker, an AP department, a premium finance company, and more. You can even send the invoice to yourself if you want to still track the invoice and mark it as paid manually.

Setting Payment Schedules

We offer three options for payment schedules.

- Pay In Full: Using this method, an invoice for the entire amount due will be sent to the recipient.

- Quarterly Payments: We’ll create 4 equal payments and send them to the recipient. We’ve also added the option to increase the total amount due by a percentage of your choice, if you wish to add an additional charge for this option. The initial invoice will be generated up to 1 quarter before the policy start date and then future invoices will continue to be issued a quarter in advance.

- Monthly Payments: We will generate separate monthly payments and the recipient will receive links to the new invoice on the same day of the month that the policy starts (e.g. If policy start date is 1/4/2024, then invoices will be sent each month on the 4th day). Each invoice is sent a month in advance and are due on the same day the next month.. Similar to the Quarterly Payment option, we allow for an adjustment in the total amount due and, further, we provide the functionality to require down payments equivalent to 1 through 8 months of coverage.

- Do not send bill: We don’t require that you bill through AI Insurance. Select this option to avoid creating an invoice and sending to the recipient.

Note: When using this option, please note that, in addition to an invoice not being generated, we will not automatically track this invoice in the Financial section of our app.

Sending an Invoice

Please note that Invoices are only generated and sent once a policy has been confirmed, or a quote accepted.

Accessing Invoices

An email will be sent to the recipient with a link to the invoice. Here’s an example invoice that was sent.

- A link to the invoice is captured on the policy. You can access this by clicking on the “Financials” tab as seen below:

- An entry for the new policy payment invoice will be created within the Financials section as seen below.

- By clicking on the invoice text, it will take you directly to the digital invoice version where it can either be downloaded to PDF or shared with another party (via the URL).

Managing Invoices

Invoice Status

Invoices can have one of 4 statuses

Owed

Approved

Paid

Void

Filters

From the Financials Section, adding a filter of Status = Owed will surface all invoices that are owed..

If using AI Insurance to also manage and track payments for Events, you can add another filter to narrow down your search to just invoices that were generated for Policy Payment as seen below:

Paying outside of AI Insurance

There may be times where an invoice will be paid outside of AI (by check, for example). To mark an invoice as paid manually, simply select it and chose "Mark As" -> "Paid"

Removing an invoice

In order to remove an invoice it must be unpaid. If it has been paid, we do not support deleting the invoice or the policy it is attached to.

Exporting Invoices

Please see our documentation on Data Export, as seen here, to learn more about exporting invoices.

Premium/Billing Changes

It’s common that throughout a Policy’s active lifecycle, that endorsements will be made that impact premium. This may mean adding insureds (Increasing Premium) or terminating insureds (Decreasing Premium). We handle this automatically for our users, depending on the payment schedule associated with the policy.

Paid in Full

Premium Increase: We will generate a new invoice to request the additional premium payment required.

Premium Decrease: If the entire premium has already been paid, then we will issue a refund. Otherwise, we'll void the outstanding invoice and re-issue a new one for the correct amount.

Quarterly or Monthly

Premium Increase: The additional premium amount will be amortized over all remaining invoices to be sent.

Premium Decrease: The decrease in premium will be amortized over all remaining invoices to be sent.

Branding

You can add your company’s branding to your invoices, thus personalizing and optimizing your customer’s experience. If you’re a Premium Billing customer, please complete this form and we will customize and send to you for confirmation.

Receiving Payment

Payment Options

We support Payment Options through any of the methods mentioned on this list. Typically, our customers will use one or more of the following:

ACH Direct Debit

Bank Transfers

Credit Card Payments (Please note that, at the time of this writing, there is a 2.9% + 30 cents fee per transaction)

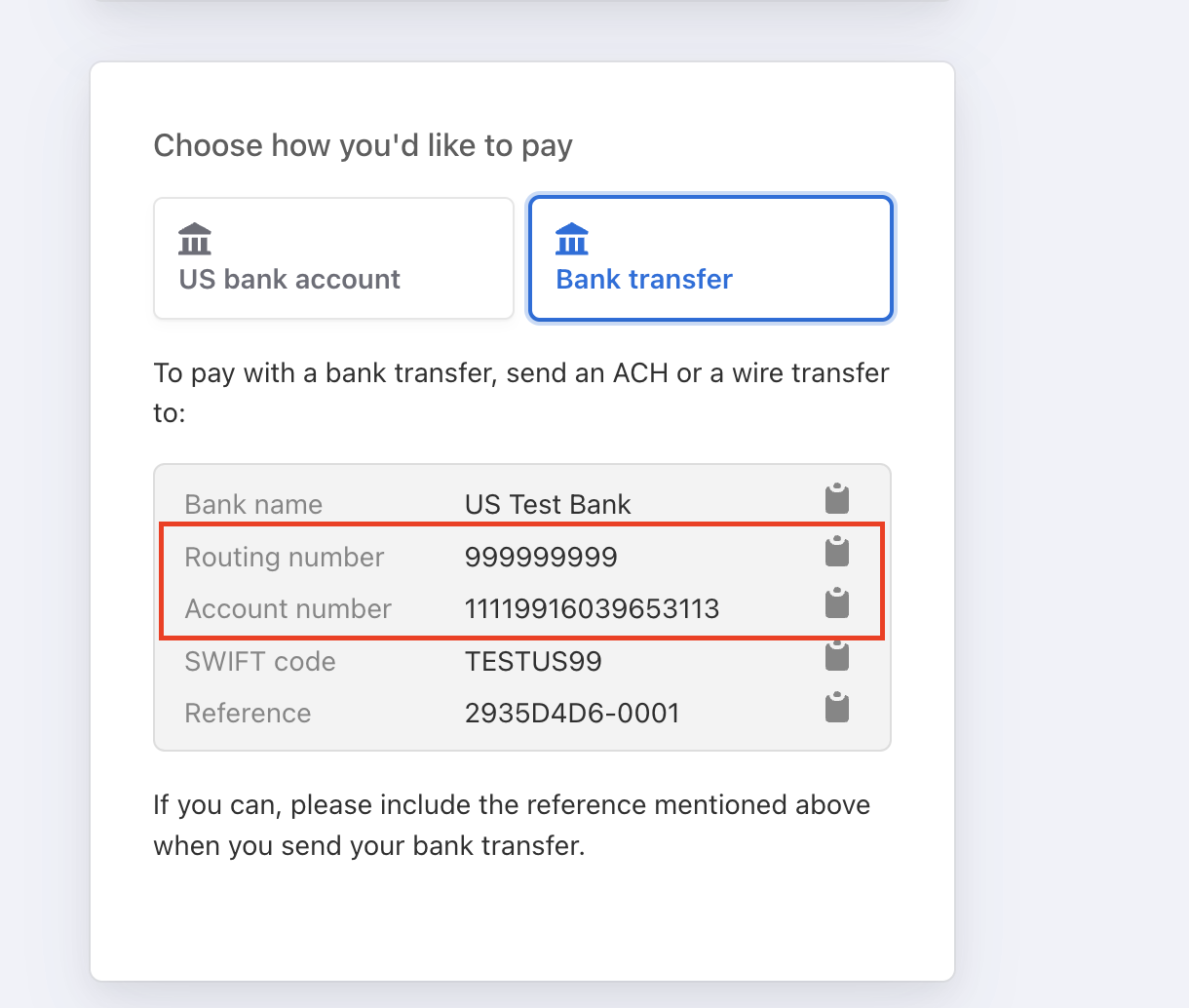

For Bank Transfers, the invoices your client receives have an account and routing number that is uniquely specific to them. This allows them to add that account information to their AP system if appropriate. All of the invoices to them will have that same information.

Please contact support@aiinsurance.io if you would like to request additional payment options for your account.

Process

When an invoice you create is paid (regardless of the payment method) it will mark itself as paid automatically. For an ACH payment the process works like this:

Your client pays the invoice to the account and routing number on their invoice, which is unique to them (all their invoices have the same info).

AI Insurance receives those funds within a day, and allocates them to the matching invoice of the same amount for that specific client

The respective invoice is marked as paid

A Payout is made to your AI Insurance Operating account daily of all paid monies

Overpayment and Underpayment

When your clients ACH funds, AI Insurance will apply them to the correct invoice automatically if the amounts match exactly.

If the amounts do not match we will apply the funds to whatever the oldest invoice that can be completely paid by those funds is. The remaining amount will be held for 30 days unless additional money is ACH'd in that puts the total above the amount of an existing invoice for that client. After 30 days, any unmatched funds will be returned to the client.

Example

Your client (Manu Corp Inc.) has 2 outstanding invoices:

- $1000 (A)

- $3500 (B)

They pay the second (B), but underpay and only ACH $2000. AI Insurance will apply the funds to Invoice A. The client's state will then look like this:

- $3500 (B) Owed

- $1000 (custodied in temporary account)

If the client ACH's the further $2500 you are owed within 30 days Invoice B will be paid. If they do not, the $1000 will be returned to them.